The fintech revolution is sweeping across India, delivering mobile-first digital banking services to grassroots Indian consumers for the very first time. In many ways, it is similar to the economic liberalisation of the 1990s that took the country from an economic outcast to one of the world’s fastest-growing economies in less than a decade. With more than 2,100 fintech companies and start-ups, India’s fintech industry valuation is estimated to go beyond $150-160 billion by 2025.

Now that India has the highest fintech adoption rate in the world, the market is ripe for fintech leaders in India to innovate and scale. However, when it comes to strategy, much remains to be done for emerging fintech leaders in India. Any upcoming fintech value creator can strategise for success by focusing on roadblocks such as lack of trust amongst the audience, misidentification of target audience, loose compliance, poor product-market fit, non-existent marketing, or lack of enough personalisation.

So, how do you build a robust fintech strategy to help you achieve your goals and stand out from the competition? The best thing to do is follow what has worked for the top fintech leaders.

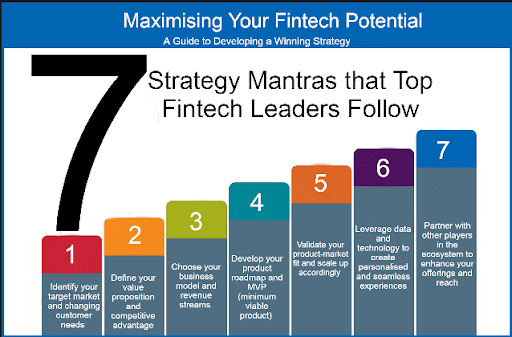

7 Strategy Mantras that Top Fintech Leaders Follow

- Identify your target market and changing customer needs

The first step in any fintech strategy is to understand who you are serving and what problems you are solving for them. Keep up with the changing customer expectations and market dynamics by monitoring trends, feedback, competitors, opportunities, and threats. Once that is figured out, work on your target market and be agile and flexible in responding to customer needs and market changes. A good example is the rise of CRED by Founder Kunal Shah. They identified that individuals with high credit scores face challenges managing their credit cards, such as tracking reward points, payment due dates, and offers. They also developed their platform to provide a simplified, streamlined credit card management experience.

- Define your value proposition and competitive advantage

Once you have a clear idea of your target market and customer needs, you need to articulate how your fintech solution can provide value to them. What benefits can you offer that others can’t? How can you differentiate yourself from the competition? What unique features or capabilities do you have? According to top financial advisors, your value proposition should be concise, compelling, and easy to communicate.

- Choose your business model and revenue streams

The next step in your fintech strategy is to decide how you will make money from your solution. You need to choose a business model that suits your value proposition, target market, and competitive landscape. Some common business models in fintech are subscription fees, transaction fees, commission fees, advertising fees, data monetisation, freemium models, etc. You also need to identify your revenue streams and estimate their potential size and growth. Eventually, diversification will lead your fintech to greater rewards. For example, Bajaj Finserv – led by Chairman and Managing Director Sanjiv Bajaj – operates on a diversified business model with revenue streams from various financial products and services, including consumer finance, SME lending, insurance, and wealth management. What started off as a consumer and auto finance company is now one of the leading fintech services providers.

- Develop your product roadmap and MVP (minimum viable product)

After defining your business model and revenue streams, you need to plan how to develop your fintech solution from idea to launch. You need to create a product roadmap that outlines the key features, milestones, timelines, resources, risks, etc., of your project. Like top fintech leaders in India and abroad, you also need to build an MVP (minimum viable product) that can test your core assumptions with real users as soon as possible.

Zerodha by Nithin and Nikhil Kamath is a prominent example of a financial services company that has succeeded in defining its value proposition and competitive advantage. Zerodha offers commission-free equity trading and has a user-friendly platform that has attracted a large customer base. Their innovative approach to brokerage fees has disrupted the traditional brokerage industry and made them a market leader in India.

- Validate your product-market fit and scale up accordingly

A key step in your fintech strategy is to validate whether your solution has achieved product-market fit. Product-market fit means that many customers love your solution enough to pay for it regularly or recommend it to others. You can measure product-market fit by using metrics such as retention rate, referral rate, net promoter score (NPS), customer lifetime value (CLV), etc., depending on your business model.

If you have achieved product-market fit, you can start scaling up your operations, marketing, sales, and customer support to reach more customers and grow your revenue. If not, you need to iterate on your solution based on user feedback and data until you find it.

- Leverage data and technology to create personalised and seamless experiences

Data and technology are the core of fintech innovation. As a digital pioneer in finance, you need to leverage them to create personalised and seamless experiences for your customers across all touchpoints. You need to use data analytics, artificial intelligence, machine learning, blockchain, cloud computing, biometrics, and other emerging technologies to offer customised products and services, optimise processes, enhance security, reduce costs, and increase efficiency. You also need to ensure that your data and technology comply with relevant regulations and ethical standards.

- Partner with other players in the ecosystem to enhance your offerings and reach

Fintech is not a zero-sum game. You can benefit from partnering with other players in the ecosystem, such as banks, insurers, payment providers, regulators, investors, start-ups, etc., to enhance your offerings and reach new markets. You can leverage their expertise, resources, networks, distribution channels, customer base, etc., to create synergies and value-added solutions for your customers. You can also learn from their best practices and avoid their pitfalls. Often recognised as the best fintech leader in India, Sanjiv Bajaj has been a frontrunner in calling for more collaboration within the finance ecosystem to scale the industry to new heights. Under his aegis, Bajaj Finserv has come up with successful open market platforms like Finserv Markets, where millions of consumers get consolidated fintech products from multiple banks, insurance companies, NBFCs, etc., for greater convenience.

Potential Roadblocks and Solutions to Scaling Up Your Fintech Strategy

- Security issues and lack of trust: Security is a major concern when it comes to mobile banking, payment apps, and fintech in general. Fintech companies can establish high-level security measures such as two-factor authorisation, biometric authentication, data encryption and obfuscation, real-time alerts and notifications, and behaviour analysis.

- Compliance with government regulations: Finance is one of the most regulated sectors. To comply with government regulations, fintech leaders in India must ensure that they are aware of and adhere to all relevant laws and regulations.

- Lack of mobile and tech expertise: Fintech companies may face challenges finding and hiring employees with the necessary technical skills. Fintech companies can invest in training and development programs for their employees or hire employees with the necessary technical skills.

- User retention and user experience: Fintech companies may face challenges in retaining users and providing a positive user experience. To solve this, they can focus on providing a positive user experience by regularly soliciting user feedback and making improvements based on that feedback.

Conclusion

Fintech is a rapidly growing and evolving sector that offers immense opportunities for innovation, inclusion and impact. However, to succeed in this competitive and complex market, one must have a robust fintech strategy aligned with the customer needs, regulatory environment and business goals.

All said and done, building a robust fintech strategy requires a lot of research, planning, testing, and learning. But if done right, it can help you create a successful fintech solution that delivers value to both customers and stakeholders. Today, there are a plethora of fintech leaders in India that are transforming the financial landscape with their innovative solutions. By learning from their best practices and applying them to your context, you can build a robust fintech strategy to help you achieve your vision and mission.