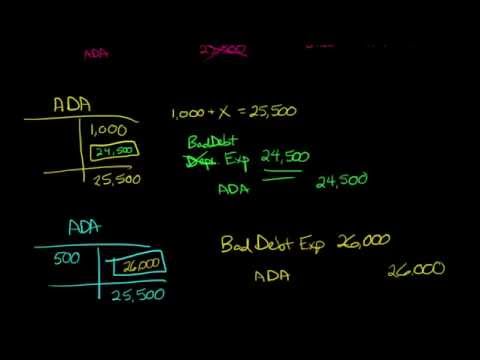

The debit is on the left side, and the credit is on the right. Machinery Purchase results in crediting the Bank account in case of Cash payment. However, Supplier (Liability) GL is credited for credit transactions. Now, debit your Depreciation Expense account $2,000 and credit your Accumulated Depreciation account $2,000. Remember to make changes to your balance sheet to reflect the additional asset you have and your reduction in cash. In some cases, you may also need to record any asset impairment that comes along (i.e., when an asset’s market value is less than its balance sheet value).

Understanding who buys gift cards, why, and when can be important in business planning. This is posted to the Cash T-account on the debit side. You will notice that the transactions from January 3, January 9, January 12, and January 14 are listed already in this T-account.

Financial Accounting

The journal entry you make depends on whether the asset is fully depreciated and whether you sell it for a profit or loss. There are a few ways you can calculate your depreciation expense, including straight-line depreciation. Straight-line depreciation is the easiest method, as you evenly spread out the asset’s cost over its useful life. And, record new equipment on your company’s cash flow statement in the investments section.

Patient Mechanical Lift Handling Equipment Market Geographical … – Digital Journal

Patient Mechanical Lift Handling Equipment Market Geographical ….

Posted: Thu, 31 Aug 2023 09:46:27 GMT [source]

Unlike equipment, inventory is a current asset you expect to convert to cash or use within a year. Debit your Cash account $4,000, and debit your Accumulated Depreciation account $8,000. When you first purchase new equipment, you need to debit the specific equipment (i.e., asset) account. Accounting for assets, like equipment, is relatively easy when you first buy the item. But, you also need to account for depreciation—and the eventual disposal of property.

Journal Entry

The balance in this Cash account is a debit of $24,800. Having a debit balance in the Cash account is the normal balance for that account. It is a good idea to familiarize yourself with the type of information companies report each year. Peruse Best Buy’s 2017 annual report to learn more about Best Buy. Take note of the company’s balance sheet on page 53 of the report and the income statement on page 54. These reports have much more information than the financial statements we have shown you; however, if you read through them you may notice some familiar items.

- The transaction of purchasing equipment with note payable is similar to the purchasing with the accounts payable.

- Equipment, along with your company’s property (e.g., building), make up your business’s physical assets.

- The only difference between merchandise purchased for cash and merchandise purchased on account is the accounts involved in the transaction.

- We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

- In the journal entry, Dividends has a debit balance of $100.

- The next transaction figure of $4,000 is added directly below the $20,000 on the debit side.

The purchases account is debited and the cash account is credited. In the journal entry, Utility Expense has a debit balance of $300. This is posted to the Utility Expense T-account on the debit side.

What is the journal entry for purchase of merchandise on account?

The debit is the larger of the two sides ($5,000 on the debit side as opposed to $3,000 on the credit side), so the Cash account has a debit balance of $2,000. As you can see, there is one ledger account for Cash and another for Common Stock. Cash is labeled account number 101 because it is an asset account type. The date of January 3, 2019, is in the far left column, and a description of the transaction follows in the next column.

Machinery is a non-current asset that helps in achieving business objectives. However, it can still be a current asset or, more precisely, an inventory. 1) All the expenses incurred for the Purchase of Fixed assets need to be capitalized. Assets (Machinery, Building, Land, etc.) can also be purchased or sold in cash or on credit. Assets purchased are not represented through Purchases but with the name of the Asset. Now, let’s say your asset’s accumulated depreciation is only at $8,000, but you want to give it away, free of charge.

3 Verifying the Post Process

The trade of old equipment, paying off an old loan, creating a new loan, loan fees, a down payment, and the new fixed asset purchase can all be recorded in one general journal. This journal entry will increase total expenses on the income statement by $500 as a result of promising to pay a 10% interest on the note payable on June 30. Computers, cars, and copy machines are just some of the must-have company assets you use. When it’s time to buy new equipment, know how to account for it in your books with a purchase of equipment journal entry. The purchases account is debited when merchandise are purchased on account to indicate that an asset (the merchandise) has been acquired.

But before transactions are posted to the T-accounts, they are first recorded using special forms known as journals. The acquisition cost of a plant asset is the amount of cost incurred to acquire and place the asset in operating condition at its proper location. Cost includes all normal, reasonable, and necessary expenditures to obtain the asset and get it ready for use.

A journal is often referred to as the book of original entry because it is the place the information originally enters into the system. A journal keeps when does your business need a w a historical account of all recordable transactions with which the company has engaged. In other words, a journal is similar to a diary for a business.

Since the company is paying with cash, that represents a cash outflow (i.e. decrease in cash). Anytime there is a cash outflow, that results in a credit to cash. You also must credit your Computers account $10,000 (the amount you paid for the equipment). But now, your debits equal $12,000 ($4,000 + $8,000) and your credits $10,000. To balance your debits and credits, record your gain of $2,000 by crediting your Gain on Asset Disposal account. Before we dive into how to create each kind of fixed asset journal entry, brush up on debits and credits.

You will notice that the transaction from January 3 is listed already in this T-account. The next transaction figure of $4,000 is added directly below the $20,000 on the debit side. This is posted to the Unearned Revenue T-account on the credit side. On January 3, there was a debit balance of $20,000 in the Cash account. Since both are on the debit side, they will be added together to get a balance on $24,000 (as is seen in the balance column on the January 9 row). On January 12, there was a credit of $300 included in the Cash ledger account.

The debit increases the amount of assets owned by the company. Merchandise are purchased either for cash or on account. The journal entries required to record the purchase of merchandise. This is posted to the Cash T-account on the credit side beneath the January 14 transaction. Accounts Payable has a debit of $3,500 (payment in full for the Jan. 5 purchase). You notice there is already a credit in Accounts Payable, and the new record is placed directly across from the January 5 record.